how much taxes are taken out of paycheck in michigan

The federal income tax is a progressive tax meaning it increases in accordance with the taxable amount. Employees Michigan Withholding Exemption Certificate MI-W4 Sales Use and Withholding Taxes Annual Return 5081 Authorized Representative DeclarationPower of Attorney 151 Notice of Change or Discontinuance 163 2020 Income Tax Withholding Guide 446-I 2020 Michigan Income Tax Withholding Tables.

Michigan Will Begin Accepting Income Tax Returns Jan 24 State Abc12 Com

This Michigan hourly paycheck calculator is perfect for those who are paid on an hourly basis.

. Switch to Michigan hourly calculator. Years of liability are based on the employers own history of benefit charges and taxable payroll Chargeable Benefits Component or CBC and a base rate. That is one of the lowest rates for states with a flat tax.

The information provided by the Paycheck Calculator provides general information regarding the calculation of taxes on wages for Michigan residents only. Total income taxes paid. By continuing to use this site you consent to the use of cookies on your device as described in our cookie policy unless you have disabled them.

Effective tax rate is the actual percentage you pay after standard deductions etc and operate on a sliding scale depending on filing status and total taxable income. If you are a Michigan resident all of your income is subject to Michigan tax no matter where it is earned except income reported on federal schedule C C-EZ E or F earned from out-of-state business activity. The median household income is 54909 2017.

The state tax rate in Michigan is 425 which is the rate your gambling winnings are taxed. How is Michigan unemployment tax calculated. Also known as paycheck tax or payroll tax these taxes are taken from your paycheck directly and are used to fund social security and medicare.

How much taxes is taken out of a students paycheck in michigan - Answered by a verified Tax Professional We use cookies to give you the best possible experience on our website. The percentage of taxes taken out of a paycheck depends on the number of exemptions you are allowed to claim. 425 of taxable income.

A 2020 or later W4 is required for all new employees. Marginal tax rate is the bracket your income falls into. Overview of Michigan Taxes Gross Paycheck 3146 Federal Income 1532 482 State Income 507 159 Local Income 350 110 FICA and State Insurance Taxes 780 246.

The Paycheck Calculator may not account for every tax or fee that applies to you or your employer at any time. Only the highest earners are subject to this percentage. The money for these accounts comes out of your wages after income tax has already been applied.

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. Overview of Michigan Taxes. The money also grows tax-free so that you only pay income tax when you withdraw it at which point it has hopefully grown substantially.

The income tax is a flat rate of 425. A common question new employees ask is How much federal tax is taken out of my paycheck While everyone knows taxes affect take-home pay it can be hard to understand how much it affects it. No Tax Knowledge Needed.

Some deductions from your paycheck are made post-tax. The average amount taken out is 15 or more for deductions including social security. It is not a substitute for the advice of an accountant or other tax professional.

Michigan has a population of over 9 million 2019 and is widely known as the center of the United States automotive industry with the Big Three all headquartered in Detroit. 2674 Amount taken out of an average biweekly paycheck. Income tax withholding rate.

Are my wages earned in another state taxable in Michigan if I am a Michigan resident. Instead unemployment recipients must request that taxes be withheld from their benefits and the withholding is limited to 10. The amount withheld per paycheck.

Check out our new page Tax Change to find out how federal or state tax changes affect your take home pay. Michigan is a flat-tax state that levies a state income tax of 425. Calculate your Michigan net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Michigan paycheck calculator.

Michigan Salary Paycheck Calculator. These include Roth 401k contributions. Local income tax rates top out at 240 in Detroit.

How much tax is withheld in Michigan. In 2022 the federal income tax rate tops out at 37. File With Confidence Today.

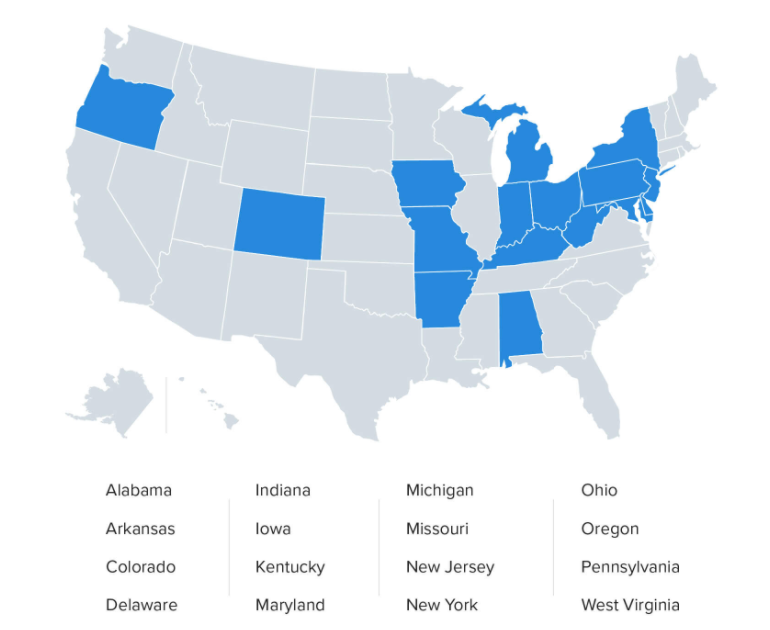

Local income tax ranging from 1 to 24. A total of 24 Michigan cities charge their own local income taxes on top of the state income tax rate. W4 Employee Withholding Certificate The IRS has changed the withholding rules effective January 2020.

Ad TurboTax Makes It Easy To Get Your Taxes Done Right. Total income taxes paid. Switch to Michigan salary calculator.

Answer Simple Questions About Your Life And We Do The Rest. Liability the tax rate is set by Michigan law at 27. The federal government considers unemployment benefits to be taxable income although taxes are not automatically withheld from benefits payments the way an employer might take taxes out of your paycheck.

For example in the tax year 2020 Social Security tax is 62 for employee and 145 for Medicare tax. If a taxpayer claims one withholding allowance 4150 will be withheld per year for federal income taxes. Michigan Hourly Paycheck Calculator.

For a single taxpayer a 1000 biweekly check means an annual gross income of 26000. I work on a farm in michigan I claimed my self as a dependent and I get paid 8 an hour what is the of tax that is taken out of my check btw I get paid every two weeks Answer 1 It works like this generally but I dont do US taxes so this is only a researched estimate. The more someone makes the more their income will be taxed as a percentage.

As a small business owner understanding how taxes affect payroll is essential to you and your employeesIn this post well tackle. In Michigan adjusted gross income which is gross income minus certain deductions is based on federal adjusted gross income. Michigan has a flat income tax system which means that income earners of all levels pay the same rate.

Calculator Salary In Detroit Mi Comparably

Michigan Sales Tax Calculator Reverse Sales Dremployee

Us Payroll And Taxes The Complete Guide To Running Payroll In The Usa

Paycheck Taxes Federal State Local Withholding H R Block

Free Michigan Payroll Calculator 2022 Mi Tax Rates Onpay

Understanding Your Paycheck Human Resources University Of Michigan

Michigan Income Tax Calculator Smartasset

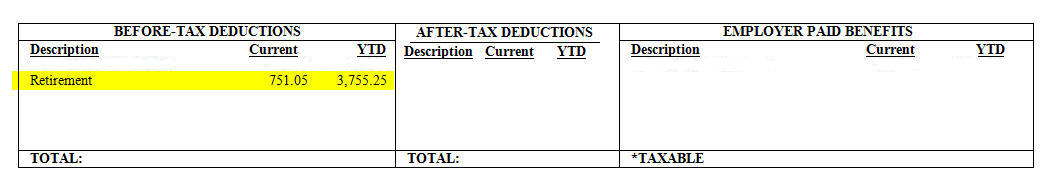

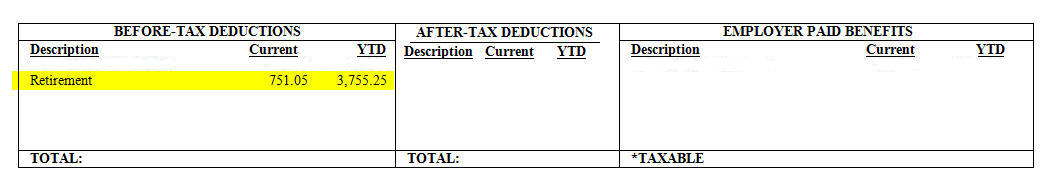

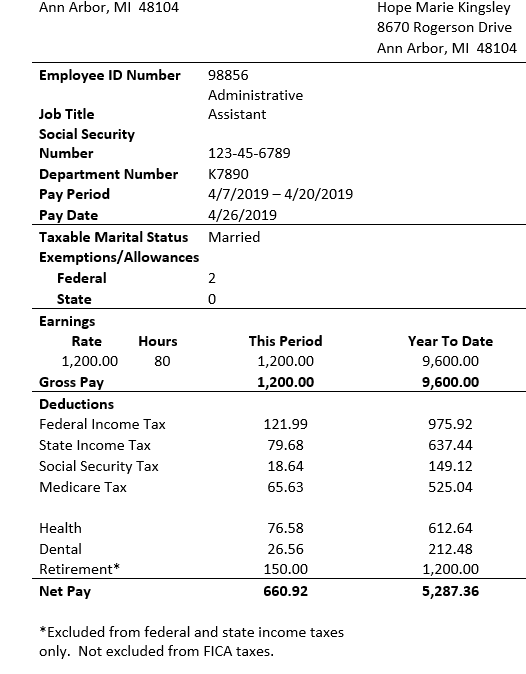

For The Federal And State Taxes The Retirement Is Chegg Com

The Tax Cuts And Jobs Act Congressman Tim Walberg

Payroll Software Solution For Michigan Small Business

Pay Stub Payroll And Disbursements Western Michigan University

Paycheck Calculator Take Home Pay Calculator

Help Michigan W 4 Tax Information

Free Online Paycheck Calculator Calculate Take Home Pay 2022

This Is The Ideal Salary You Need To Take Home 100k In Your State

Michigan Income Tax Calculator Smartasset

Understanding Your Pay Statement Office Of Human Resources

Tax Withholding For Pensions And Social Security Sensible Money