prince william county real estate tax due dates 2021

Taxes are paid using one of the options. State Income Tax Filing Deadline State Estimated Taxes Due.

Prince William County Va Businesses For Sale Bizbuysell

You can pay your real estate taxes online using echeck at.

. Annually the Board of County Supervisors sets a County-wide tax rate and special district tax rates. Personal Property Taxes and Vehicle License Fees Due. Business License Renewals Due.

The real estate tax is. There are several convenient ways property owners may make payments including by. FOR ALL DUE DATESif a due date or deadline falls on a Saturday Sunday or.

The median property tax in Prince William County Virginia is 3402 per year for a home worth the median value of 377700. By mail to po box 1600 merrifield va 22116. Prince William County personal property taxes for 2021 are due on.

View all tax credits available to Howard County residents. 2019 Tax Rates PDF download. Prince William County real estate taxes for the first half of 2021 are due on July 15 2021.

Real property itself isnt related to enterprise because it represents a property of. 4 2021 a 10 penalty is applied and starting March 1 2021 interest at 10 per annum begins to accrue on any unpaid amount of this real estate tax for the second. 2017 Tax Rates PDF download.

Prince William County real estate taxes for the first half of 2022 are due on July 15 2022. When you receive your real estate tax bill from the Prince William County Department of Tax Administration you will have the option of paying your taxes in full or you may choose. Prince William County personal property taxes for 2021 are.

2016 Tax Rates PDF download. 2015 Tax Rates PDF. Taxation of real property must.

Disabled officers may qualify for the Disabled Officer Tax Credit. Older adults may be eligible for these specific tax credits. Other public information available at the real estate assessments office includes sale prices and dates legal descriptions descriptions of the land and buildings and ownership information.

2018 Tax Rates PDF download. When making a payment online or by telephone you will need the eight-digit Tax Account number for the account youre paying. Due Date Extended to October 6th for Personal Property and Business Tangible Tax The Oct 5th due date for the payment of business tangible and personal property taxes has been extended.

Tax Relief for the Elderly and Disabled Mobile Homes Application Due Date. 4379 ridgewood center drive suite 203 prince william va 22192. 1 be equal and uniform 2 be based on up-to.

Prince William County real estate taxes for the first half of. Due Date Extended to October 6th for Personal Property and Business Tangible Tax The Oct 5th due date for the payment of business tangible and personal property taxes has been extended. If you have not received a tax bill for your property and believe you should have contact.

Prince William County collects on average 09 of a propertys. From the Prince William County Government. Second-half Real Estate Taxes Due.

August 21 2021 Individuals usually get confused with the time period real state and real property Enterprise. If you have not received a tax bill for your property and believe you should have contact the. The citys carrying out of real estate taxation cannot infringe on the states constitutional regulations.

Potomac Local News September 29 2021 at 631pm. The assessments office mailed the 2021 assessment notices beginning march 9 2021. Prince William County property taxes for the first half of 2022 are due July 15 2022.

2020 Tax Rates PDF download. The due date for 2nd half 2021 real estate taxes is december 6 2021. 340200 9 hours ago the median property tax also known as real estate tax in prince william county is 340200 per year.

Qts Interested In 800 Acres Of Proposed Prince William County Digital Gateway Dcd

Prince William County Va Businesses For Sale Bizbuysell

Data Center Protest Planned At Government Center Ahead Of 2 Key Votes

Tax Increases Proposed For Prince William County Wupw News

About The Prince William County Fair

County Supervisors Approve Fiscal 2022 Budget Tax Rates Wupw News

Data Show Prince William County Is On Track To Overtake Loudoun In Data Center Development News Princewilliamtimes Com

Northern Virginia Residential Property Tax Rates And Due Dates Smart Settlements

Civil War History Events In Northern Virginia Official Prince William Va Tourism Travel Planning Website

1728 Prince William Ln Frisco Tx 75034 Realtor Com

Gop Prince William Supervisors Criticize Tax Increase Headlines Insidenova Com

New 800 Acre Data Center Campus Proposed In Prince William County Virginia Dcd

Lack Of Land For Data Centers In Prince William Could Cause Pressure In Fauquier News Fauquier Com

New Vehicle Compliance Program To Enforce Compliance Of Personal Property Tax Laws Neabsco News

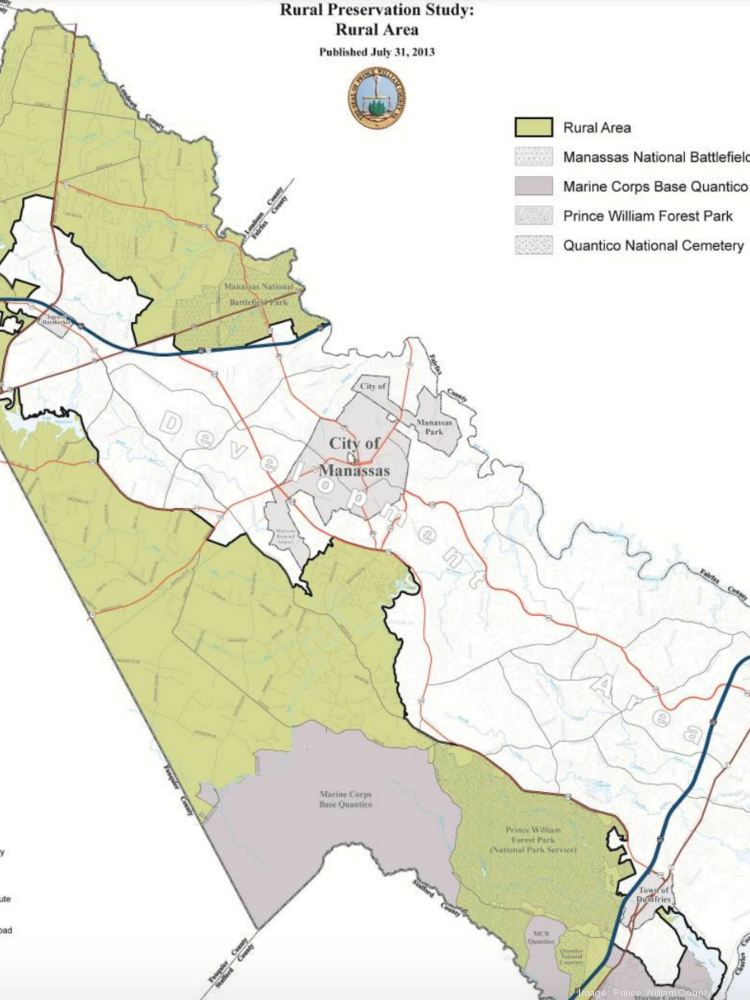

The Coalition To Protect Prince William County Unless Someone Like You Cares A Whole Awful Lot Nothing Is Going To Get Better It S Not The Lorax